Click here to get $10 off the 2 book bundle - great for gifts

Special bonus - Get an electronic copy of "Reared In A Tent"

Simple Steps Blog

Looking at housing costs

Often it is good to be able to realise what makes the price of housing so expensive. How those components are costed depending on the location, distance from facilities,e.g schools, shops, power, town water, sewerage, hospitals and Doctors, etc.. Obviously, if one has all of these things within easy access to a house the price will be at a premium. Older houses will often be expensive, and maybe not so modern looking but very solidly built. By knocking an older place down, means the extra cost of new materials at today's prices together with paying tradesmen; and by the way, the building will most likely not be as solid. Hard wood timber is hard to destroy.

The questions to be answered are:

- Buy a large acreage of land, have some animals to keep the grass down, without being connected to the grid, and go solar. That will keep the frequency of bills down, and the initial set-up costs, and maintenance will have to be considered.

- Opposed to buying an established house out of town with town water, power and sewerage, close to a train line/bus route, and commute to the city as required; and use the local schools, where commuting by bicycle is possible, and shop locally.

- Some will say that if the older house needs a new roof, floor levelling/restumping, a kitchen and bathroom make-over it would be better to knock the place down. I believe by doing these improvements gradually, one at a time, and paying cash there will be less risk and lower repayments.

- A good question to ask yourself is, "will this expense add more value to my house"? If the answer is yes, the improvements made will increase your capital return on the house when it comes time to eventually sell.

Land as well as land sizes, together with infrastructure, are probably the first stumbling block, and most likely to absorb two-thirds/half of the final build.

There are so many houses being crushed to the ground, even though their construction was very solid, and will subsequently end up in land-fill; some of those timber floors are worth keeping; weather boards are bullet proof. Funnily, depending how one views this, these materials would far outlast the new composite building materials. New is not always better. Mind you, nothing beats a new kitchen and bathroom at today's standards, plus some built in cupboards.

The important thing is have a plan and keep working towards the goal.

Pennies Make Pounds

For the young folk it would be "cents make dollars". Yes, the theory has not changed in all my years. Lately, while listening to the cry about homeless families, it keeps ringing a bell that says "start young, have a simple savings strategy".

It would be great to get feedback, or a review confirming that some folks are following my savings tips. Simple plans do work! It does require consistency, and some discipline. Mind you, I am of the opinion the new trend that is pushing "bank cards" for regular use will further erode savings plans. Imagine it is not necessary to scratch around in the purse for loose change, but just swipe the card! So simple, yet such a trap. Keep a track of the spending through receipts, or regularly glancing over the bank statements for clues as to where the wages are going.. There is another sneaky thing happening with small bank fees attached to card transactions.

Please, for your own sake, be patient to grow an investment savings account and, like me, you will get that long awaited deposit eventually. It is right to think the first $50k is the hard part. However, it will work even if it means giving up a few luxury items like cups of coffee ($5.50 a cup); weekend breakfasts at $30; and the taxi/uber to work, after sleeping through the alarm!

Folks, I am sure you get it; you can do it!

See Chapter 4, and please read it every time you feel yourself going off track! In the first instance, it took me 8 years to gather a reasonable deposit for a modest home. Who cares if the place you find is out of town. The important thing is you have entered the market. Good luck!

Comparing the struggles over the last century

Just now I feel this need to give the young folk some insight into the past, and to not lose hope with their savings, and ability to get their own home.

This post will show that it has not always been cream and honey! Somehow there seems to be an illusion that the older folk have lots of security and assets, as though it just happened in the olden days because things were so cheap. Assets do increase in value over many years usually due the population increase, and inflation, not necessarily due to spending heaps of money.

Yes, it is true that I have lived through hard times, but not with the same struggles as some other families. Thanks to having a large supportive family, a Dad that believed all problems were meant to be solved, and who were always willing to offer some help to each other, more in the way of bartering. Cash was not an option when it was in short supply.

Don't be fooled because things were cheap; at the same time wages were very low, and essential items were not easy to access.

Housing and land always seems to come into the News when interest rates change, families get restless and start moving north/south looking for a better opportunity by way of jobs and promotions.

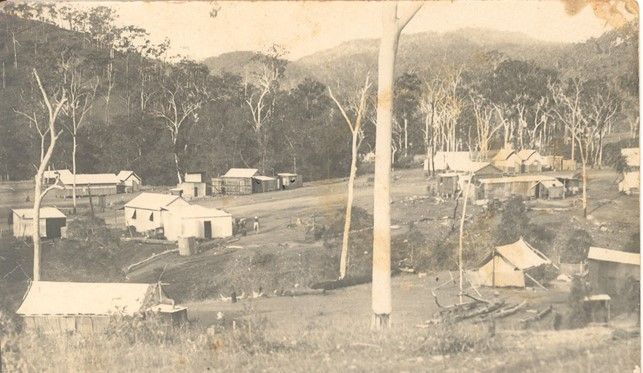

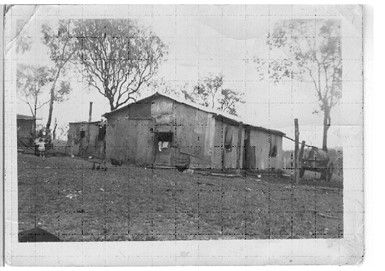

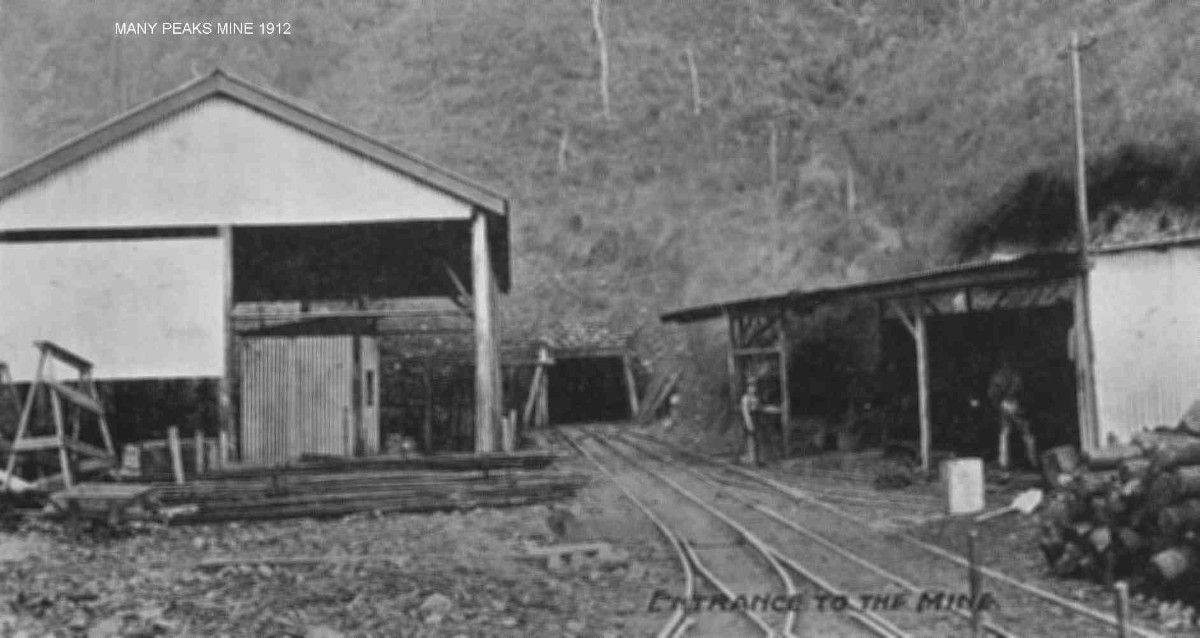

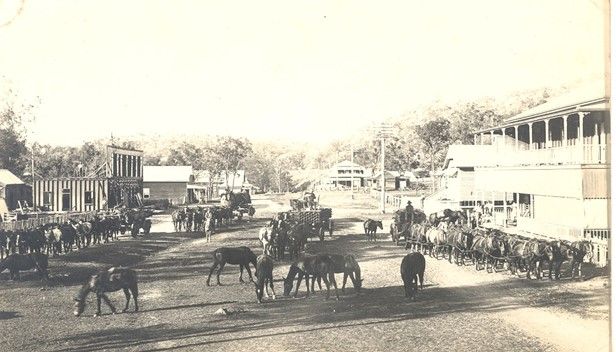

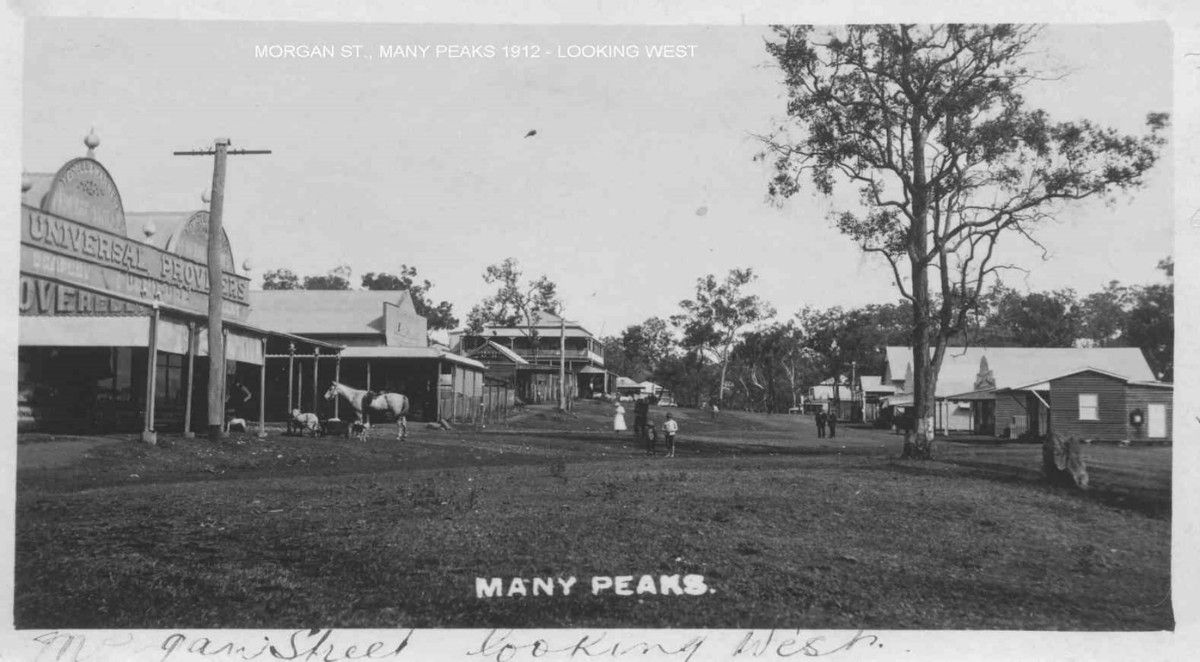

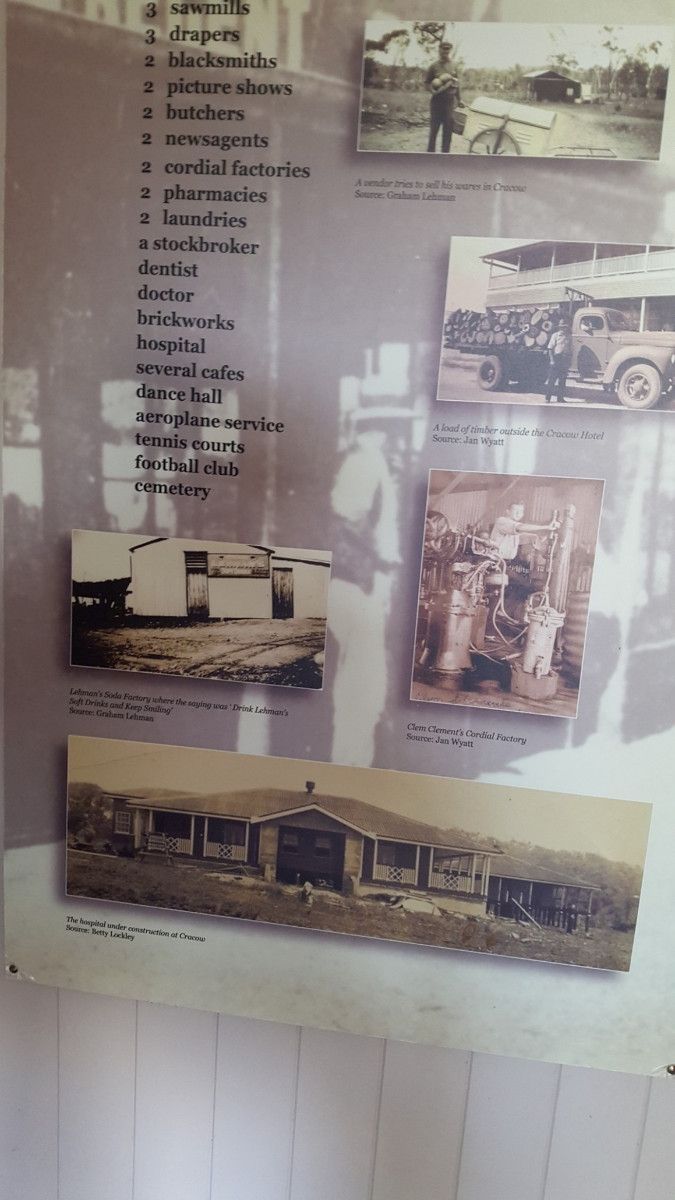

These photos may give you some insight into what I recall over time, having heard the older generation now deceased, who survived two wars, two depressions, and lived through horse and sulky times, witnessed the first motor car manufactured, managed without electricity/power and town water, built make-shift huts to live in, camped in tents while searching for work, managed to survive and prosper. This generation are now benefiting from their perseverance and hard work.

1. 1870/1920 Bullock teams working at Cania Goldfields. |

2. 1989/1912 Boiler Monal Mine |

3. Early 1902 - 64 horses (3 teams) pulling a boiler over Gentle Annie, Monal Mine (boiler in photo 2) |

4. Monal mine homes |

5. Early 1900 A familly hut at the River in the Monal Creek area |

6. 1907 Many Peaks Mine |

7. 1907 Many Peaks township |

8. 1907 - Many Peaks Shops |

9. 1932 - Cracow gold rush |

10. 1938 - Photo courtesy of Cracow Museum - foreground is the Cracow Hospital. |

11.1948 Our family home at Kalpowar

|

|

1927 - It took 10 years to phase out horses as a mode of transport. The Dicky Seat was popular in the 1930's. |

1917/27 Golembil to Barramoon Railway Tunnels was constructed. Since the closure of the railway line in the 1960's it has become a rail trail for visitors. |

|

Further thoughts on reviewing the market

There seems to be so much to expand on following my previous blog, especially when I have heard some off the cuffs comments people make when they inspect a property. It can be off-putting to hear something like "I don't like the bathroom", "that bedroom is painted an awful colour", etc. and in the big scheme of things that does not have that much bearing on the valuation. What are the important questions to understand when accessing the real market value?

Land

- The location of the land, view, and suitability for the family in terms of terrain, size, and accessibility for parking, and kids playing, as well as proximity to schools, shops, bus, etc.

- The current value of the land in the area, taking into account the pros and cons.

- The expected increase in the price of the land over time (its potential).

- Consider if it is worth buying a house that is affordable, with the idea of upgrading in a few years, or rebuilding. renovating or relocating. These are worthwhile thoughts irrespective of what the future brings.

House

- How much work, how much effort, and time would be required to make this building into a liveable home?.

- Who would do the work?

- Would any approvals be required, and would the home be liveable in the meantime, especially if the structure has to be altered?

- How much money it would take to extend/refurbish?

- Approvals take time, and time means money.

- Will it be possible to do these improvements without wrecking the budget, bearing in mind plumbing, rewiring, roofing and restumping can be expensive.

- Is it worth the cost for the long term gain, or should it be a short term goal to sell after a few alterations and move on to the next home when appropriate.

Another thought comes to mind, is to consider if these planned improvements will require sub-contracting out various tasks of the project.

For the inexperienced buyers

- Check the council zoning to be sure your plans will be approved.

Sometimes it might be surprising to find the land far outweighs the value of the building on the land, and this does not mean the land is a bad investment. As years go by, the once out of town houses have become prime real estate, in spite of their age; particularly when it is close to the city, bus-ways and an area that has full infrastructure in place. Fortunately land does not age and is desirable for other purposes, whereas buildings can become neglected if not maintained.

The obvious things to me now are, over the years the land becomes more valuable and the building may not, unless it has been constructed well, and solidly in the first place.

Refer to Chapter 6, Invest Wisely, Page 18

Summarising the last six months

This last few months have shown some extreme sides of real estate, with the ebb and flow of things in the market. It does prove that hanging on in the market is vital when things go "pear shaped" and keeping patient to weather the hard times. All markets eventually twist and turn, and panic can be the worst thing to do. Of course any investor who is under capitalised will feel the brunt more, whereas the person who saves to have a buffer in case of a downturn, or change of circumstances, will ride the "storm" with less pain. When a downturn is apparent sit tight and not be fooled by other bargains. No kidding, by making the right decision can save thousands of dollars in the long term.

A bit of luck comes into this also, and being patient for the market to turn around can be nerve-racking. So the interest goes up, and it comes down sometimes, when the economy is healthy. Circumstances are not always in our control, that is, to expect the value to keep increasing, to hope the rent will increase, to expect a tenant will be able to accept the rises, and so on. To panic and sell is often not the right decision in the long term, especially knowing you have a good property that must eventually increase in value over a few years. Think of other ways to defray the costs, for example, take in a boarder.

Always keep yourself financially informed, and keep a clear head. I recommend a "brainstorming" session with other like minded people before acting prematurely.

Refer to Chapter 6, Page 18.

Save not Spend

Sometimes I hear comments, and requests, and demands that "tickle" me. I heard this comment the other day, "there are more coffee shops than people; you cannot build an economy on coffee shops". The short story is, if every school leaver would save a small amount from their first pay, and kept this habit of SAVE, not SPEND as their motto, their middle age would be comfortable. Take out the savings first, then rely on the balance to live on per week/fortnight if discipline is a problem.

Over the years, when trying to put away savings for investment, I have asked myself many questions before just handing over cash, ie

- Did I need this article before I came into this shop

- Have I got an immediate use for this item

- Is this item necessary or does it just look cute

- Is this item needed or is it wanted

- If a particular item is outside the budget, just wait and be patient.

Most "feel good" spends are short lived, and can add up to a lot of ones savings, for example, cosmetic stuff; eating out at expensive restaurants regularly, eating prepared lunches by visiting the local sandwich/milk bar daily.

There are other ways to limit purchasing day to day items as well. To prevent a crisis in life is a great outcome, and can be achieved by having a life time of constant habits, and sufficient savings to draw on in an emergency. Do not use credit cards, do not borrow money unless it is for an investment with potential gain.

Give yourself a "self esteem talk" session. Seriously, those organisations who pay for advertising want a SPEND result from the consumers. Therefore, more publicity and attention is given to the people who do not have budgets, plans, or constant thinking patterns when it comes to saving. Some prefer to "fly by the seat of their pants", and that is fine; however, don't expect calm at a time of emergency.

Annual Inflation

Today's Livewire released the following statement:

"Annual inflation of 3% per year could reduce your income by one-third over 14 years. Inflation in Australia is at a level not experienced for decades which is of particular concern to retirees, who don't have a rise in wages to balance out the loss in purchasing power of their investments. This white paper explores different options available to help protect against unexpected increases in inflation."

This small insight sure hits a cord once you realise what it means in the long term, at the same time striving to build up capital, that will lead to a comfortable retirement.

In a nutshell, the sooner one settles down to make a plan to save, less of the residual savings will be lost to inflation. The initial goal is to enter the market and, at which level will be dependent on the length of time it takes to build up the capital (deposit), as well as how serious and constant you are with your budgeting. Each day, when I hear the outcry for "help" for affordable housing, I can feel renters concerns, and at the same time realise I was once in their "shoes", and proceeded to keep going to ensure I would get started in the market at some point in the future. It is not rocket science, though it is discipline over a long period of time.

In Chapters 4 and 5 of my book I do discuss this initial process, and ways to speed up the budgeting process.

If this article has been helpful in any way please put a Testimonial on my website.

Where do I fit in this present market?

It is often hard to know when it is the right time to make an investment decision, especially if you are a newbie saver, a first or second time investor, or have a big mortgage to pay, and so on. Also these decisions have to be made in consideration of ages and marital status plus the ability to pay the debt. In fact, recently I have heard how young people got started into the market by pooling their savings and that can work in the first instance to get you started. This is a good move for a few years until the capital increases enough to be able to sell at a profit. By going down this pathway I have a few suggestions:

- Make an authorised agreement that would cover things that might become contentious as time goes by.

- Choose your partnership knowing both/or a third party are responsible and solid workers.

- It is a good idea to partner with a person with similar financial personality and goals (not a spender and frugal person together).

- Put a limit on the time frame, say 5 to 8 years, to give the partnership the chance to split and go their own way.

- Write some notes about the pros and cons of this arrangement and try to discuss them openly.

There are lots of variables to this idea, however, even if it means sharing the property in the first instance, and plan the property purchase with this in mind, particularly if both are renting at the moment. Keep reminding yourself it is a business deal, as others can often come along and try to undermine the plan.

It can work to your advantage and must be dealt with like a business deal in spite of the fact you might be friends with your proposed business partner.

Prices are dropping?

The News has to have stories, and the content has to get people thinking and concerned!

It is a fact that values of real estate fluctuate and are not under our control. The things we have control of are:

- How much deposit we save.

- Whether the borrowings are going to be affordable in an upwards or downwards market.

- When we decide to sell.

- Keep a track of the real estate fluctuations in price.

- Note what causes the rise and fall in prices in some areas and not in all areas.

By following the above trends it is heaps easier to understand the reasons for the spikes and troughs in the market. This, in return, can give us comfort about our investment and prevents fire sales that usually happen at the wrong time.

For those who find this information helpful please write a review on my website "blog".

Thinking things through

Looking back over decisions that were made can be inspirational. It is hard to ignore what makes people change their ideas and pattern of life. This is probably why I have always been curious when talking to people that seem to be wise in their outlook, or maybe more methodical.

Housing and real estate has been interesting to follow for me, since I spotted a scrubby bit of land for cheap in the early 1960, and took a punt on spending the last bit of cash we had that was allocated to buy our first TV. I am sharing and reflecting now.

My blog seems popular; people do like the stories; are scared to pay a few dollars for my book which could help them get onto a solid track to becoming a house owner, never mind if it is yet to be your home. It is very likely that house will not be in a place that you preferred. It is important to move with the market.

Listening to people talk, it is more about their financial situation at the moment and their inability to afford a home. In the first instance it would be more achievable if the focus was on buying a house, and the home can come later on. Think about how it would be possible to change the goals, to firstly, get into the market. Once in the market, the investment value will vary as the market changes. This concept, I believe, would be more achievable.

Management of Customer Assets

Recently I read an article regarding the management of customer assets, and then it turned my attention to "lost assets" (brokers going broke, banks going broke). Of course my mind immediately switched to the benefits of real estate assets. Why?

- Land cannot get lost, though the paperwork might get misplaced.

- A house on land cannot be stolen, though if bought in a bad location, at worst, may get flooded, and sometimes get resumed to widen roads, etc though that is rare.

- An asset that occupies physical space and has deeds registered in the owners name, cannot be sold to another person. There is a reason for Stamp Duty, even if it feels like a "rip off" at times. Providing the rates are paid, and the rules of the shire are adhered to you remain the registered owner until the property is sold. It is not necessary to dig through copious amounts of records to find the real owner. There will be an address listed at the Lands Department stating who is the registered owner of the property, plus a few more details regarding the sale price, date sold, amount paid, etc.

It is a great feeling to be able to visit the address, see it, touch it, and improve on it as required, keeping in mind the zoning of the property and the building regulations. The important part is in these unpredictable times of hacking, scamming, and manipulation, it is more difficult for the crooks to tamper with.

Scotty's Reality Show

Folks if you think my blog topics are worth the read please put in a Review.

A couple of nights ago I turned on the TV just in time to witness the Block Auction preparations. There were five couples and 5 homes completed over a three month period.

In my view this was a different product being offered, probably to attract a different clientelle. These homes were not priced for the faint hearted buyers with a "reserve" price of $4m on each home and out buildings. I had not followed this series from the beginning, though I do like following the real estate market. The preceedings went as follows:

1. The first house was slow to reach the reserve price, and finally got to make a $20k profit for the couple who did all the construction as well as painting, landscaping, furnishing to strict deadlines. The mood in the Block camp was glum while Scotty kept a positive attitude, and tried to assure the contestants things would move forward into a worthwhile reward.

2. The second house seemed to have some buyer interest prior to the auction. Bidding was a little slow at first and then took a leap to make a good profit of $1,600. Plus they were rewarded in the end with a $100k bonus; the contestants had mixed feelings about the market and emotions were running high.

3. To get to my point, the next three houses did not reach the reserve price, in spite of the auctioneers trying to encourage higher bids. All three properties were handed back to the Agents/Auctioneers for further negotiation. Understandably this created tension in the camp, and it is likely the first sale may have been passed in for negotiation as well, except the whole auction went so quickly an inexperienced seller, not being prepared, took the low offer with trepidation.

Whilst it was general knowledge the market was slowing down, this auction definitely sent a clear message of no confidence in the current state of the economy. Those buyers who have CASH will be in a good position to capitalise on a downward market. If the buyers need to borrow, the lending institution may require additional collateral, such as the deeds of another property, to guarantee they do not lose if there is a CRASH.

Finally, please keep saving and budgeting to build up as much collateral as possible, and purchase real estate within your means. It does not matter if it is not your perfect house; though it needs to be in a good position with good value; just call it "a stepping stone" for the future!

Rising interest rates have made buyers think twice

Thinking twice does not mean do not do anything. It does mean to reassess the plans previously made. I guess a good rule would be to keep thinking as circumstances change, especially when borrowing.

From experience, it has shown that when things are good, it is unlikely to stay that way. On the other hand when things are bad, it is unlikely to stay that way either. The main thing is to be able to set your finances up so that it is possible to cope with the changes no matter which way the interest rates go, and how other things in ones life will fair, for example, the amount of the mortgage, the amount of money coming into the home each week, as well as the necessary outgoings. Working out how much one can "tighten ones belt" while waiting for the times to change.

It is hard to digress from the basic principles of saving no matter what comes and goes. For example, when there is extra income, increase the mortgage repayments, to build up as much collateral as possible, which will put a safety nett in place for unexpected changes in the economy, the family, the work place, and so on.

At no time should we give up, even if our goals take a little longer to achieve.

Don't be a slave to your "stuff"

Sometimes we can have things all together with our thinking and other times I think we are slow learners!

Firstly, the idea that money is made round to go round is just a joke. The best things we can have as we age are:

- good health

- good attitude

- a solid job

- regular exercise

- loyal buddies

- and a will to succeed/survive.

Try, try, try again. Get rid of the things that drag you down, like:

- the takeaways

- the fizzy drinks

- bread and scratch

- the pick me-ups

- the smokes, the booze, and there is more!

Once a person's mind is clear the sky is the limit.

Ponder on the things that take up your precious day and then look at ways of converting that energy to a fruitful thought/mindset/activity.

Pros and Cons - buying as opposed to renting

Buying as opposed to renting. Following on my previous blog regarding applying for a Government housing concession we look further into the pros and cons. This is not a short term question as sometimes people are in between jobs, looking at work changes and so on, and that is not the time to go hunting for buying a home unless one can afford to keep it to realise some gains. Whether we like what we see when we look forward, it is still a good thing to imagine a person's world that seems to change every ten years or so. In my mind I prefer to look at what life will look like when we are around retiring age, and I get a bit taken back when I think of what the pension, and health of a person would look like, and how much more of the income would go into health related services that just did not seem important in the prime of life!

Recently I have witnessed a person who is in the last ten year phase of their working life and who has chosen not to buy a home, and whose rent has risen to a figure not much different to half of their weekly pay. Unless there is an inheritance it will be hard to get established and ready for retirement. While maths was not my favourite subject I can still do simple arithmetic, for example, 52 weeks x $400pw is easy then times 25 years (or proportionately breaking down the rent a bit further), plus the removal costs, the bonds and so on. Of course there can be little blips along the way to overcome whichever way the senario is looked at.

Pros -

1. The mortgage payments will add up to give the payee enough security (collateral to move on if necessary).

2. Those mortgage payments will not be lost providing the investment is sold on a solid real estate market. It is not always an up market just at the time one wants to sell, and some patience will be required, as there is no point in making irrational decisions.

3. Yes, a market is a market, and the idea with all investments is to ride out the highs and lows, and nothing is lost until the "hammer goes down" at the Auction.

4. There is a choice of renting out the investment and renting elsewhere, if circumstances change and the location does not suit, or a job transfer comes about.

Cons -

1. A home needs to be maintained and that can be hard in the early stages of the mortgage term and repayments in relation to income may not look that great.

2. Taking on a bit of part time work to increase the weekly cash flow.

3. Another one of my blogs does go into looking at extra expenses for a home owner.

4. The landlord can arrive or send a message with the agent "this house/flat/unit will be listed on the market for sale in two weeks" and then this horrible period of chasing a rental, packing, moving stuff, changing addresses, disconnecting and connecting services commences.

Finally, it is noticed that a long time investment home does not stir the owner into change as quickly as when a new owner comes along having borrowed a heap of money, and wanting the tenant to pay off the mortgage with the weekly rental. Yes, the old owner may now have paid off the property, whereas the new owner has started with a fresh mortgage and a large debt to repay.

Thoughts when applying for a Government housing concession

This blog is about looking into the pros and cons of taking advantage of a Government Housing Scheme, which in the particular scheme I am thinking of would require 2% deposit.

The first thing that comes to mind is how much in real terms are we considering accepting to help us, for example;

- 2% of $500,000 = $10,000

- 2% of $350,000 = $7000

Once establishing this figure together with your savings, it can be figured out what amount your loan will need to be and if that is feasible.

The second thought is how much one can afford to pay for on a fortnightly basis?

Are the repayments going to be equal/close to what I am paying my landlord in rent per fortnight at the moment?

How secure is my job, and will my superannuation help to offset the borrowings when I retire?

My last blog discussed the ongoing bills that keep accruing as a home owner.

If you like reading my articles there are more than twenty Blogs to browse through, and adding a Testimonial would be welcome.

Refer to Chapter 6 for more detailed information regarding evaluating a purchase.

Owning a home does bring extra expenses

Sometimes we can think "I wish I had enough money to pay cash for a house". It seems a fact of life that no matter what we have it always comes with extras.

Paying cash does not preclude the owner/s from ongoing bills. Besides, the ongoing utilities to pay, like water, rates, insurance, electricity, plus there is the other important thing and that is when maintenance creeps in. The carpets, fans, stove, air conditioners, etc can start to deteriorate. It can be depressing to see a home start looking "tired" and the owner has no budget to fix things bit by bit. As well, there are usually improvements and extra touches that families like, but do not need to be added, particularly as the family grows. Then it can be the presence of pets or kids that dictates the need for a fence before the luxury items.

Many folk love pools, and that extra attention to the pool maintenance and the accessories like pump, filter, vacuuming, chemicals can easily stretch the resources too far.

Of course lots of these extras are able to be done over many years, particularly if the owner has the skills, or is able to follow U-tube Tutorials!!

If a person does not like "hard yakka" it could mean a revision of priorities, and in some cases selling the home.

I am certain lots of people like the content of the blogs and it would be very helpful if those people would leave a Review/Testimonial. It does encourage me.

Low land and floods

After all this rain it seems appropriate to talk what it would be like to have your house and land in a flood area, and watching the water levels rise.

We have agreed that the land is the most valuable thing provided it can be utilized in all weather, especially for crops, cattle, or for fresh air, views and privacy, etc. If land does get affected by swollen creeks and gullies it does lose some value as crops get spoiled, cows/stock get caught in currents and carried downstream. fences get washed away. Homes, nevertheless in a "safe spot" can give great views just the same.

A block that has minimal high ground can be difficult to renovate/adjust to cope with the high water levels that seem to come about every few years. However, having a lowset brick house takes time and money to change, though it would definitely be worth it for the peace of mind knowing the property will ultimately be valued heaps higher (a forced saving for the future) plus add many more great features to the home. Personally, adding a top story to a brick lowset home would increase the usable area and give great views over the slopes. A wooden home gives more flexibility when it comes to lifting, and building in underneath, and cheaper in the first instance. Stairs/internally can be a bug-bear to some people though installing a ramp may be possible.

I did not say to demolish the low set brick home, but use it as a car garage, rumpus area, store kids toys, Dad's toys, as well as install shelving/storage at least a meter off the ground. There would be some savings by using the existing roofing, sliding windows, sliding doors, internal doors and cupboards, etc particularly if the upstairs level was a mirror image of the basement.

To me this seems a good project, and one that will give the owner rest and peace of mind when the next flood is imminent.

If you want to order and read more blogs go to ritapaulos.com

Extras when buying and selling property

It is helpful to be aware that each time property changes hands hidden expenses maybe lurking around the corner, and that can make a short fall in finance/available cash, since it is at the end of the deal. Consider things like:-

- Capital gains tax

- Building Condition report

- Pest inspection reports

- Conveyancing/Solicitor's fees

- Agent's commission

- Stamp Duty

- Centrelink reviews of any change in income status/allowances

- Insurance

- Rates/Water adjustments

Then, when the contract is settled, there can be extra bits and bobs that crop up just when the finance is stretched to the limit, for example, attending to things mentioned in the Building and Pest reports like leak in the roof, toilet cistern has a drip, drainage from the overflow, etc. Then feeling overwhelmed the reaction can be "where has my profit gone?".

Land tax can also be something that comes about and eats into the profit of your sale; the rules are different though similar, in each State of Australia. The following example gives the guidelines for Queenslanders:

Total taxable value of $680,000

Tax band is $600,000–$999,999

Tax calculation = $500 + (1 cent × $80,000 excess)

= $500 + $800

Tax payable = $1,300

Of course these figures will vary from region to region; however, in all countries there will be charges or fees and taxes similar to the above.

The Market Predictions

The market predictions are not always that easy to understand, and though it seems that prices only go one way - UP at the moment for property and DOWN for shares, this is how the pendulum goes.

I am a person who does not go for "broke" when I do things, and I take a conservative approach, for example, spread my investments around so that when one thing is UP the other might be DOWN and vice versa. Every market is always easier to see after the event. Funnily, I hear things like "I should have, I could have..." but so sorry that is too late now, which makes me smile. When the market gets ridiculous in price it does chase investors elsewhere.

No matter what, the best approach is to own as much of the outlay/investment as you can, hence always have a savings plan as a means of reducing debt. With property there is always hidden expenses cropping up, like leak in the roof, the toilet cistern dripping water, a storm requiring an insurance claim, and it goes on, eating into the profits.

The next article will be about hidden costs when selling/buying property.

About the expensive housing market

There is a lot of talk about the expensive housing market. The following points need to be addressed like:

- The cost of replacing your house when you sell.

- The distance from services, eg hospitals, doctors, shops, busways, train line, and so on if buying elsewhere.

- Consider what may happen if Interest rates go up some time in the future; this would be inevitable on a 25/30 year loan. .

- Building materials have gone up in price partly due to the demand on supplies during the boom, and in some cases certain products are out of stock.

Having cash readily available is a great asset, or having an investment that can be converted to cash as required. This will give a lot of bargaining power knowing the contract will not "fall over" waiting for the buyer to obtain finance.

I remember when interest rates were 14% (and return on money in the bank was reasonable). It was not a matter of what you liked, or preferred, it was a case of who would lend a buyer the money in the first instance. It was just settling for the basics and hoping in the future those luxuries could be added, eg a back verandah, a second toilet, cement driveways, etc..

The world has become an instant gratification arena. There is still merit in caution, beware of the points above, and always factor savings into the budget.

Is the bubble bursting

The first indication that the bubble might be bursting. is when a real estate agent did not get one looker at an Open House yesterday afternoon. Yes it is uncertain times when the share market is down, real estate has gone "through the roof". It is hard to discount the fact that the market cannot keep buoyant when interest rates are predicted to rise and the share market is going through a correction, something will "give" soon.

The bottom line is, keep saving to increase your deposit, which in turn will lower your borrowings. The lower the borrowings, the easier it is to survive in the long term, in spite of the interest rates.

Best of luck for 2022.

Time for field inspections

Happy New Year to all my readers.

Now is a perfect time to take notice of the flood levels; the high ground, the land affected by swollen river banks, and to get some idea what some areas might experience in a wet season. This might give further thought about whether to have a low or high set house. Drainage is important for other reasons as well especially if the build is on a low set slab. Nobody wants water rushing down the hill and surrounding the home, and leaving a lot of saturated muddy ground outside.

With the current demand on real estate it is a good idea to have a few things sorted out that will count when in a cue to buy a place, ie finance is organised, let the seller know if it is a cash sale as that will make the purchase contract more secure, so the deal does not "fall over". Insist the Solicitor does a thorough search for hidden problems like mine shafts, flooding, proposed road/highway/freeway development, and the like.

Just a reminder to check out all the features that are on your check list, eg that the ensuite has all the necessary fittings like a toilet, shower, storage cupboard, dressing room; if there are additions/renovations to follow down the track be certain a deck can be positioned in a nice spot without the sun blaring in your face. Something I am not happy about with the new homes being built since there is no provision for parking at least four cars off the street. Most people seem to be using the covered waterproof parking as a storage area, hence robbing the home of car spaces.

I hope this information is helpful when planning your next move.

How far out of the city is a bargain

To some extent this will depend on the size of your "purse".

I was privy to hear details of a good buy at Mt Warren Park which is 37klms from the CBD via the motorway and freeway. It is a huge double block, with a good aspect, and the home is solid though does need some tlc. This buy does give the new owner a lot of options, eg live with parents, rent it out, future subdivision, add another dwelling onto the land; this also will give some further options. I like options.

If a young person is looking for a block and finds something like this it would be hard to go past this opportunity. As the years roll on this block, which is in a tidy street, with a good aspect, can only get more valuable in the long run.

Happy New Year folks.

Getting Lucky

How often do we hear the phrase "it was luck". We often hear the good luck stories, but not the bad luck. Yeah life can be a bit of a gamble.

Firstly, one has to be in it to win it! Hoping and wishing does not "cut" it!

By making a loud statement "I intend to buy a roof over my head" seems to reinforce a commitment that leads to prioritising some of our actions and decisions. Self talk is, I am and I intend, I will and that is strong thinking.

By reading blogs on my website (ritapaulos.com) there are many ideas and suggestions to focus on positive planning. Maybe this is the time to make a New Years's resolution?

Merry Christmas everyone.

What a difference a few years can make

This is a true story. My son had worked about 7 years and was planning to go overseas for a few years. He had enough savings to put a deposit on a town house in outer Sydney, which the Financial Advisor had suggested he consider buying. Even though he was nervous about using up his money he decided to go ahead with the purchase. Of course the town house was tenanted through a real estate agent while he was away. I did encourage him for all the obvious reasons.

There is nothing worse, in my opinion, than spending all your money on a trip and coming home broke! Looking ten years down the track my son has not looked back, as he was able to buy a home in Sydney on his return from overseas a few years later. Yes, there were times when he wished he had that deposit to spend on a trip! Usually this is what it takes to give you a "kick start" into the market. He also has learned it was not rocket science, though it was a little inconvenient when he could not get his hands on the money.

If you think this through in relation to your own situation, it is possible you may have a similar opportunity.

Click here to read more Blogs.

Helping the School Leavers Plan

Life can be a bit daunting for school leavers who feel they need so much and generally have little funds to back up their dreams. As time goes on suddenly school leavers will be calling on their knowledge and hoping to be independent at some time in the future, say in five years time. It is understandable when one is "stoney broke" the last thought is to create a savings plan. Really saving is a habit just like any other consistent thing that a person does. Maybe start with putting a small amount in a "sock" expecting to have enough to make an overseas trip. Never mind it is still a plan and plans can be amended. As a few months go by, maybe after the initial splurge of buying a few items off the "wish list", is to realise it is time to save for a "rainy day". I hate working for nothing. Ideas like:

- Put aside 10% of your wages in a special account.

- When you get a pay rise after a birthday or promotion, always put a percentage of that into your special account.

Revise how that plan is going every six months and amend your spending habits particularly if you lose faith in your plan working consistently. When you are young you have time to alter your plan if things did not work in the first place.

I am forever grateful that I kept persevering as it takes time to build up collateral. Oh! to reach that $50k mark. It will gradually happen if you just keep plodding along with the plan consistently.

Short term pain, Long term gain

Today I was reflecting on this very old adage "short term pain, long term gain," which saying apparently came from the Doug Ford doctrine. Suddenly, as I thought about it, this meaning was relevant to a lot of things in life. It seemed to apply also to my recent skin graft. The Dr said "limit your walking for a couple of weeks, I have done my bit and now it is up to you". This instruction did not fit in very well with my lifestyle! Now into the fourth week of recovery and, as a last resort, I dragged out my crutches to use since healing was not happening fast enough. The lesson for me "keep revising what you are doing"! This analogy seemed to apply to following a savings plan, to ultimately be able to become a home owner, and reach independence.

Please keep coming back to your plan to:

- Revise

- Amend

- Alter

- Rearrange

- Prioritise

Whatever it takes to get a positive outcome.

I am not a Financial Advisor though I have been a determined, practical, consistent, flexible thinker and when success is eminent I really dig my heels in further and reach out a little more. Never give up.

Determined to trim down the expenses

Funnily enough, anything that suggests a change to the daily routine may not be received well by everyone in the family. Well, not everyone embraces change or has the same priorities; some think a miracle will happen sooner or later! Following are ideas that will promote discussion in order to breaking the ice, for example, take a look at what some daily habits/routines are costing, particularly if "Mum's taxi" is not available!

Cars are a depreciating asset and it would be worth delving into the pros and cons as to why two cars are necessary, as things like:

- Registration

- Insurance (check the car valuation relative to the policy)

- Maintenance

- Tyres

- Fuel

- Parking

- Depreciation

are taken into account. All the better if a company car is provided.

Also there has been some fluctuations in electricity prices recently, and it is a good idea to periodically check that your service provider has passed on any savings to you. The same can be said of phone company's too as this is a very competitive industry. I get ticked off when a company offers a new customer a good deal, and the old loyal customers tend to get left our when deals are handed out.

Try giving each of the following ideas a try for a week, ie take the bus/train to work; ride the bike on the bikeway, park the car close to a train station instead of using a parking station.

When I put some figures on the cost of a cup/mug of coffee daily, as well as lunches and morning and afternoon tea the costs escalate just a few dollars at a time, and at the minimum can add up to around $20 a day. If coffee for morning and afternoon tea is a necessity, replace it with coffee in the satchels like Mocha, Flat White, and so on; they do come in packs of 10 satchels which will last for the week. Put your preferred milk in the refrigerator in the lunch room. Take lunch, eg., a hamburger, rice paper rolls, salad, fruit, etc and walk to the local park and feed the scraps to the birds. This is a way of getting the necessary daily exercise at the same time. In fact just for a change I bought a prepared take-away lunch the other day and it was $10 and that did not include a cuppa or fruit.

Conservatively, the estimated savings would be around $10k per year. Double this if a couple have a similar routine.

If you are shaking your head at my reckoning, it is easy to just keep the receipts in a jar/folder for a couple of months; or maybe glance over the credit/debit card statements for confirmation of costs.

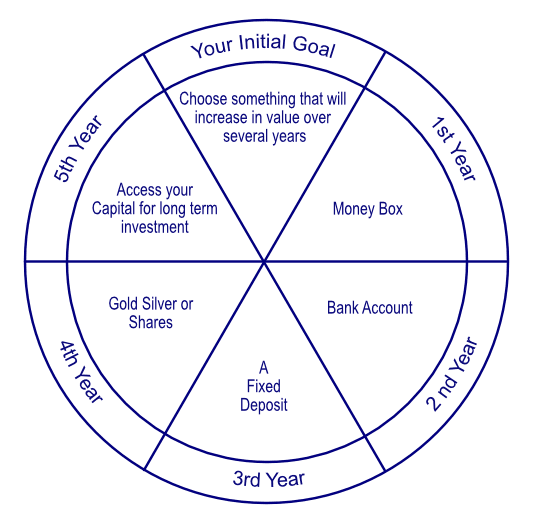

The first savings plan

Some folk might be stuck on first base and reading on might open up a new idea. Making a small goal could be an easier way to get started than going straight for a goal that could be three of four years away. Setting a huge goal from the outset might make you feel despondent when this is a totally new concept of managing your funds. To gain confidence in the first instance start with, for example, try to get a saving of $500 into the bank account by allocating $20 a week; don't worry about what to spend it on as there will be heaps of things once you make a list. Just prove to yourself that you have the discipline to carry out the task and reach the goal. For example:

- Aim to save $500 into the bank account.

- Set a bigger target, say, plan for a small holiday.

- If things are working well and goals being achieved maybe it would be time to save for a car with low mileage.

- Make a list of achievable goals, put them in order of priority and keep moving the target!

- Separate this money from other money, even if that means using a money box, separate bank account with a lock and key!

If you suddenly get tired of the discipline, and "let's party" keeps flashing into your mind it might be time to compromise for a while by just taking stock of where you have come from and maybe things like, is it time to apply for a different job, study or work extra hours to speed things along. It is not time to give up!

Imagine the disappointment the following day if you "just blew" that first $500?

Some saving guidelines

Some rules for saving:

- Set some guidelines

- Keep focused

- Stick to the plan

- Do what is logical and straight forward

- Don't put your eggs in one basket

- Seek advice from wise people

- Learn and research

Google is such a wonderful tool!

Instant gratification

How "instant gratification" plays out in reality. A simple thought "I want things now" can shoot through a persons mind. This can apply to big and small, inexpensive and expensive purchases.

We do appreciate more, and value more, as well as give more thought to those things we save for and plan for. Instant gratification can mean the savings can be frittered away on "little stuff" resulting in no budgeting for the "big stuff" that can take five years and more to accrue enough savings for the "ready". You know what I mean, a night at the pokies, opposed to socking it away for things that will last a life time and appreciate in value. Imagine this happening monthly for five years!

I once took the attitude of "save a lot, spend a bit" when we were saving to cater for our growing family.

Reflecting on 5 years

Reflecting on things, particularly if you keep a few records of prices and development, to remind you of what a difference 5 years can make.Try to turn your mind back 5 years and reflect on the differences you can notice,ie both maturity, developmentally and financially. Now cast your mind forward 5 years, eg when you were 25/30, 30/35, 35/40 and so on. If the answer is "things are much the same". Why? Too scared to take a forward step? At the end of 5 years it might seem that the forward step was no big deal. Then, it might be one of those "should have, could have" scenarios.

I guess my point is about being patient and consistent. Society seems to have adopted "an instant gratification" approach to life which at the same time can cause stagnation/procrastination. Try not to let this mind set, which might delay progress, become the norm for the rest of your life.

Chapter 13 will be useful as it has some tools to assist going forward.

The challenges to scrape up that deposit

There are challenges of getting started to become a home owner, for example:

- Saving for a 20% deposit to avoid paying mortgage insurance. Why? Because that is likely to cost an extra $100 a pay.

- Looking at the existing rent and how that puts a big hole in the weekly savings.

We will look at a few calculations to get an idea of where we are heading with this savings plan:

- What if the weekly rent was $35 a week better off, eg from $420 a week down to $385. Calculated $1,820 savings a year

- Looking at other ways of increasing the weekly savings, for example, cost of fuel, parking, lunches, take-aways, outings, impulse buying, cheaper rent, that might bring the savings up to $50 per week. Calculate $50 x 52 = $2600.

Another positive idea is to live on one wage and save the second income:

- Imagine, just working on a modest hourly rate, one shift a week could mean an extra $150

- Cumulatively, that $150 plus the $35 saving on rent above adds $185 x 52 weeks = $9,620 a year

I love putting pen to paper as it seems to highlight any flaws in our system! KEEP ON KEEPING ON!

PS - My "shares" to the blog articles has risen to more than three hundred. It would be great if anyone who has followed any of the ideas in the blogs could write a Review/Testimonial.

Upside v Downside of markets

From experience I have noticed a trend following a boom. Things like:

- The real estate market can stay the same for ages.

- In time, a shortage of houses to buy comes about as buyers get impatient searching for what they want

- When interest rates drop that gets borrowers very interested finding ways to take advantage of the situation

- After a boom the building construction continues and as demand drops that can cause an over supply

- Subsequently interest rates rise, people want to quit and move on for reasons like; i) mortgage too high ii) job opportunities get scarce iii) people panic as they see the market stagnate

Finally, the crunch comes where the seller may have a choice between hold or quit. In the main this comes about because buyers over commit.

PS - The adage that it can be cheaper to rent than buy is dubious in the long term. It is all in the timing.!

Property values in Qld.

Some things are not making sense to me. The metropolitan area property where there is infrastructure and services have increased in price about one third, more or less. The country districts, especially near the coast have doubled in price, for example from $200k about two years ago to $400k at present. In these quieter towns the owners have built mansions and it seems they are not bothered about schools and hospitals. The fact that the closest medical facility is an hours drive away must be acceptable too, as the public transport would be non-existent.

All I can think is that the property was bought for cash and rising interest rates, as well as work opportunities are not in the equation.

Maybe retirees are looking for a quieter existence, slower pace, less traffic as well as more boating, fishing and crabbing opportunities!

When is the selling/buying peak

As I continue to walk around and gaze at the vacant blocks as well as half built or renovated homes, I wonder if a peak in the market has been reached, or will real estate keep increasing in value. There is a big delay from start to finish of this upgrading/building/renovating dream. My next thought is, when is the top of the curve? Sooner or later? There is a lot of homework to be done before committing to such a big project, for example:

1. Will we/I need to sell or get out of the existing residence to increase equity/reduce my borrowings.

2. Is it likely Mum/Dad will offer accommodation for a few months while we realise some of our equity. If not, how much extra cash will be outgoing for rent?

3. I am noticing that once the initial purchase of land/house has been finalised things seem to slow down a lot; probably because it takes time to consider/finalise Council approval, surveys, finance and so on.

4. The real things have to be weighed up, ie: exactly what to do to firm up the plans, when will the home loan interest rates rise, and how much will the rise affect the mortgage repayments, will all the required building materials be available when needed, what percentage cost increase will apply once the contract is ready for signature, approximately how long will it take to finish the build and get things profitable again.

The pressure seems to be on once the builder actually gets started and that is the time all these little details have to be sorted out, eg the colours, the cupboards, the lighting, the styling for the bathrooms, making compromises if the materials are in short supply, or if it is decided to change the position of a power point, window or even a doorway.

One vital thing is to know if the builder/contractor is solid and will finish off the work to your satisfaction without a hitch.

Think long term

To think long term does require patience, especially if it is a first purchase as people often lose sight of what is important in the long run. Remarks that can cloud the mind like "I don't like the kitchen, the stove is old, the wall colour is drab, does not really matter in terms of the value. It helps in terms of offering the seller a lesser price. Focus on the real things that add up to long term gains, ie

- the land size, location, accessibility, the drainage, the structure being solid, the roof condition, the potential. Things you could call the "bones" of the purchase.

At worst, if the goal becomes too hard, settle for a 2-bedroom unit or townhouse; something affordable and rentable that can form a stepping stone to a future purchase a few years down the track.

When I hear young folk talking about what they would like, as opposed to what they can afford, some things do not add up; for example, the cost of living in the inner city areas when considering the land values, the overall cost for a first home buyer, it can be too tough. Attaining the real goal might take two or three intermediate steps before reaching the ultimate purchase.

Looking Outside the Square

Let's think of ways to get into the home owner market:

- Get $100k dropped into your lap!

- Start off by buying a maisonette or townhouse for a few years until the property increases in value making a sizeable deposit for the next step.

- Once you own land/house there are more choices when and how to extend the house, particularly if the family has extended/grown.

- If a family member is renting think of a way to provide dual living by way of adding a granny flat either underneath or at the back of the house. This idea will add value and give options down the track.

Once a person starts becoming more daring in their approach to owning a home it will be surprising how much notice is taken of how others achieved their goals.

Think big about the future possibilities.

Good Luck or Good Management

More sharing of stories to encourage intending home owners/buyers to have a plan, a criteria, a time frame, a budget; and why I get so passionate about spreading the words is what I witness on my daily walks around the local streets with so much demolition, refurbishment and building going on. My lucky story is I have lived here for more than 35 years and witnessed the prices skyrocket.

There are many theories about investing, some simple, and some analytical. So here are a few to ponder:

- If there are more buyers than sellers the price goes up.

- If there are more sellers than buyers the price goes down.

Fluke infrastructure plans promoted by developers and approved by Councils, eg

- A shopping centre springs up locally.

- A bus route is extended.

- A state of the art Secondary School is announced within easy access or walking distance.

- A Medical Center opens locally.

- A coffee shop pops up around the corner.

- A retirement village is planned, and so on.

These things gradually have a positive impact on the areas popularity, which in turn creates demand, hence real estate valuation increases. Yes, it is relatively easy to spot good locations, but there is a lot of luck knowing "when and how long" it will take. The good thing is if you are young time is not a huge factor.

When values are inflated the only "snag" can be a downturn in the economy leaving some home owners/builders vulnerable. This is where a certain amount of luck, and persistence to hang in for the right time to sell really pays off. See Chapter 9.

https://www.ritapaulos.com/content/archive/simple-steps-blog-by-rita-paulos

My thought for the week

As I walk each day and gaze at the local streets' happenings there is a repetitive trend, of which I have mixed feelings about. Why?

- The number of FOR SALE signs coming and going weekly..

- Agents hungry for listings, letter box drops, phone calls, emails showing results of recently sold properties. It is a HOT market around here.

- Skips and bins appearing on the footpath.

- Survey pegs being driven in as good sized blocks are being cut into two blocks.

- Demolition gets under way in most cases. In a few cases the houses are being bought and refurbished or lifted and extended.

- Earth moving machines start demolition, trucks appear to take away the pile of sticks and concrete, and levelling for the foundations are under way.

- Tradies utes and vans decorate our street on a daily basis.

Another home bites the dust. It is hard to come to terms with solid, strong structures ending up as rubble.

This is what is sending the new home buyers and especially first home buyers further out of the inner city suburbs. Mind you this suburb was an outer area in the 1950/60's!

Make a plan - a track to follow

Chapter 9 discusses "good luck or good management" thoughts. When I repeat this phrase over in my head a lot of things, stuff, reasons, ideas, people, flash into my mind, all of which have a different "take", on living,,as well as how to plan, and what road map to follow through life. When all is said and done acquiring things is about "return on equity" when it comes to accruing savings. For example, not every hard working person earning a living would give much thought about how to turn $1,000 into $2,000 and so on. In fact I more often hear pleasant remarks how the spare cash was spent on a nice car, nice jewellery, beautiful lounge and a week at the coast. All of which has its place at the appropriate time.

It took me a few years to realise a balance could be had by "spend a bit, save a bit". Am I hitting a familiar cord?

All of these ideas came to me after a few years of working at things constantly and at the same time really getting nowhere. Mind you, in the days when interest rates were higher, say 17% at Custom Credit, it may have made it easier where to lock a few hundred dollars away for a couple of years, so the capital would grow..

Simply explained it was about building equity through owning things that appreciate in value.

Ways to change a plan

In Chapter 13 of Simple Steps to Success I talk about the things we can control. Sometimes we have to make changes, we have control of that process, and maybe amend our plans to suit to keep forging ahead. With the rate some real estate has taken a forward leap it is understandable how some folk would feel dejected about having enough savings to buy a home. Trust me, it will be possible later rather than sooner.

For changing how we approach our future plan, let's break down the process of saving into small pieces, as follows:

1. Revise the current budget.

2. Check if there can be savings on current bills, like electricity, water, phone, internet, mobiles, shopping, lunches, take-aways, parking, fuel and so on.

3. Use YouTube for instructions when simple, though necessary repairs, are needed. Ideas that will help spend less/save more, such as:

- Changing tap washers

- Painting, and staining woodwork on decks/pool fences

- Washing and polishing the car

- Use of the washing machine one less time per week will effect a water and power saving

- Yard maintenance

- Holidays per year, taken when and where and how often.

I know some Tradies who do a few odd jobs on their day off. If you are a bit handy imagine earning $100 a job or doing overtime would help heaps especially if it is saved for a long term goal.

Another possibility is to change focus on the initial goal by looking at houses/land out of town as a means of "getting into the market" and building up equity.

Rent or Buy

Rent or Buy

There are different views expressed about owing/renting a home/abode. Let's look at some of the talk:

For renting:

1. There are no worries about rates, insurance and maintenance as the landlord takes care of that.

2. It is easy to pack up and go elsewhere.

3. Moving to another place every six to twelve months can become a painful chore.

4. There are rules that prevent being able to please yourself especially personal preferences.

5. Each time the lease expires there may be a choice of extending the lease/choice of moving location.

6. The expense of moving the household items like refrigerator, washing machine, lounge, can be costly.

7. Disconnection/connection of power and gas.

8. Changing postsal address for mailing purposes.

9. Advising the Electrol Commission of the new Electrol Division for voting purposes.

To buy:

1. The mortgage will be constant until sold or adjusted as interest rates rise; or refinance.

2. The choice of purchase will be more attractive, as there is a wider choice of purcchase, eg house and land, unit, town house, duplex.

3. The mortgage repayments will increase your equity, and that figure will depend on how long the purchase is kept and what the state of the market is when sold.

4. Any improvements to the property will increase the value, i.e carport, 2nd toilet, ensuite, etc.

5. It is my opinion that the land is the most valuable thing, and if in a few years, it is decided to sell the property, particularly in an "up market" the choices are many. Always try to hang on for a profit.

6. If life is throwing a few negative things in the way it is always possible to become a landlord and rent the property until there is an economic turnaround or indecision has passed..

Finally, every market has its highs and lows, troughs and swings, always making it advisable to look into those trends before selling/buying.

Keep those savings plans going until your goal is reached! Chapter 6 gives some solid tips.

Discipline and forward planning

Chapter 3 is about discipline and forward planning. When I look back those vital years of working, planning and discipline seem so short. When one is in their twenties "the world is your oyster". What? Yes, time to party, time to consider a family, time to become educated in a chosen field, time to devote to hard work, time to excel and shine in so many ways. It is easy to realise why planning, organising, and discipline are necessary to go forward in so many directions.

For me the most frustrating thing was to work hard, and still not get ahead. That is when it is time to re-evaluate the system of planning and organising. The important thing is not to give up. If at first you don't succeed, try, try and try again.

I would love some feedback in the Testimonials from people who have been inspired/motivated by the encouragement in my book.

Reaching a Balance

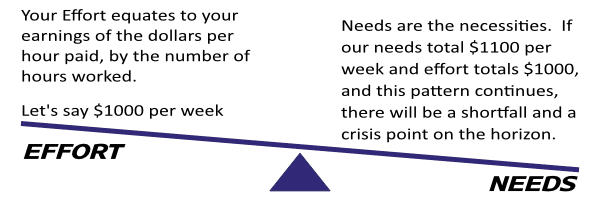

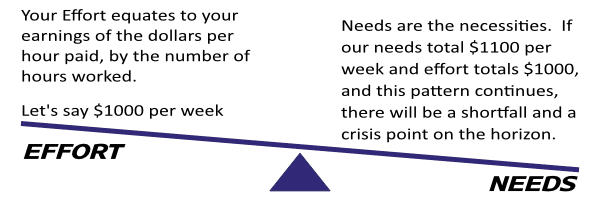

In Chapter 4 we look at the needs v effort theory that helps make financial advancement very straight forward. Simply put, imagine working one more shift or day per week. It is easy to think "oh that is not worth the effort/inconvenience". Broadly speaking that shift (say, $250 a week) can have a significant impact on the budget, that is:

- Bring the purchase of land/house/home forward by $13,000 a year.

- Assist making the mortgage repayments more manageable.

- It possibly would mean getting into the market a year earlier, saving on "dead" rental money, reducing mortgage payments even further.

- As well as most likely short circuiting an impending house price increase that would be likely the longer the loan for the house is stalled off.

There was a saying long ago "pennies make pounds".

A popular street

Here are some photos taken today of houses under a makeover in this street that is just three blocks long. You will notice some are being refurbished, while others are demolished to make way for new homes.

Most first home buyers would have been content with the original home in spite of its age, as those building materials are so strong and tough and the timber might be hard wood and resilient though more challenging to work with. A bit of clever imagination by a draftsman or architect could have turned these houses into a modern family home that would have blended in better with the style of the era.

It would be remiss not to mention that a frontage of 12.5m does not allow for a lot of scope when constructing a home from scratch. Many blocks are split in 2 lengthways leaving a small frontage.

It is interesting to notice one home has been painstakingly refurbished using recycled timber. It has been a very long and patient project and I have no doubt eventually will look tops. Has anyone got the skills and patience? It shows it can be done, meanwhile during construction, their home is a neat home office building at the back which is saving on rental while the owners keep plodding along.

If you find my blogs interesting and informative please click here to give me some feedback. I would love to hear from you.

The building boom

My book has not touched on the pitfalls that can be around once you have got your home deposit, and your building loan. In my book I do speak of having more cash and less borrowings to be on the safe side. However, some "recent events" (those dreaded fires in the south, cyclone damage in the north, the first home buyers entering the market, together with low interest rates being offered at the moment), have caused extra demand on building supplies due to the necessity to rebuild. Any bubble in any industry is good, though, unfortunately tends to push the industry off balance.

Recently the news has surged relating to the home builders construction boom. For those considering engaging a builder there are some considerations and further questions to be answered, like:

- Is the material readily available for the project.

- The supply and demand on building materials may affect pricing of the job, and the ultimate cost of the finished project.

- The subsequent shortage of what is needed to keep the workers employed continuously, together with the rising costs of materials, may not end well for all concerned.

Nothing would be more devastating to a home owner to find their builder becomes insolvent. One other idea could be to pre-purchase the materials before commencing the project!

Government grants

There was a lot of interest when the home builders grant was announced. There was a rush to get things underway before the application expiry date.

It is so easy to get "hooked" in when something is offered "for free". When my nephew asked me about this benefit I asked:

1. Do you really need this extension to your house?

2. How much will it add to your loan repayments?

3. Will you get any income from the extra outlay?

4. Have you thought of doing the extras for cash gradually, section by section?

There is a positive and negative for most things particularly when borrowings and interest repayments are involved; not for just the time being, but for another 20 or so years to come.

Often, once the list of questions and probabilities are considered the answer becomes more apparent. It is so easy to get carried away when things sound a bit exciting.

Chapter 4 will give more ideas.

Striving for a healthy body

This week I had reason to reflect on Chapter 11 where emphasis is on striving for a healthy body and mind. Vitality and well being go hand in hand with a well balanced diet and exercise which in turn will help increase stamina and overcome stress, frustration and depression.

How come I changed focus in this chapter? Without vitality it is hard to meet the challenges that can come our way. Things like your car breaks down; your rental gets sold under your nose; the process of getting back into a stable residence; dealing with agents; chasing up paper work; adjusting to rising costs of a home/rental can be exhausting.

Clues that will help keep a clear mind and lower stress levels will help, for example, listening to relaxing music, walking along the ocean shore, deep slow inhaling and exhaling, talk to a trusted friend and so on. In fact anything that helps bring positive thoughts and a clear approach to go forward.

Surfing the net

At the present time it might be a chance to surf the net and compare land, rental and house prices (by the way I kept my records of real estate advertised for years to reflect on the change in areas over time). There is a high demand on real estate in built up areas at the moment which is changing the market a lot. If you are young and have many years on your side, and providing you do not need the infrastructure in place right now, therefore, you do not need to pay for those extra services now. Without those infrastructure charges added to land costs, the idea would be to just let it sit and wait until the time is right.

Position, position

Once I used to joke about where our home was situated, and I was quick to say "high in the hollow"! Over time this statement makes more sense as now I realise "high on the hill" is usually more valuable land! Why is it more valuable?:

- the land is out of the flood plain

- better drainage during heavy rain

- the breeze circulates freely in hot and humid weather

- the views can be stunning

- the design features of the home can give a feeling of space

Chapter 6 talks about being wise when choosing your investment.

What If?

Just now I was revisting Chapter 10. It seems no matter what we attempt in life there is a "what if" factor.

Sometimes I smile at how this "what if" statement is not taken seriously at all, eg excessive speeding when driving, turning corners suddenly without due care, tail-gating, climbing ladders, and the list goes on. Yet, when it comes to securing ones future, hours of "sweat and tears" go into considering every little detail!! Is this because we do not want to sacrifice any freedom to achieve some gain? When you think about it, probably as much thought should be given to spur of the moment actions as one slip-up can destroy ones future plans.

Limiting your spend

For sure I am not a Financial Advisor, however I have had enough experience to realise the more you spend the less you save. Having limited savings for the future ultimately lead to a "pretty ordinary" old age. Bear in mind reaching retirement and owning a home is a huge help.

Another way to force long term savings is to boost your "super" funds. You will benefit from that at retirement, and the earlier contributions start the more return at the end. This of course does short-circuit the amount of planning required to get a reasonable return on your money though it will be locked away for some years.

If you find my tips are helpful please go to the website and add your thoughts under Testimonials.

A good buy is a good buy!

A good buy may not always be what you want though it may suit your pocket. Give some thought to how you could turn this initial spend into a more suitable opportunity later, eg newer, bigger, better location and so on. A profit is the initial aim of the game. Be sure not to sit on the profit though, and gradually fritter the gains away as this could then take you back to where you started from.

Think clearly and wisely. Refer to Chapter 3 for some motivation.

Managing your money

The question is spend or save? Maybe I should have said "don't spend your money unless it is necessary". Certainly don't spend your money if you do not have it. These days it is so easy to fritter your hard earned savings away without anything to show for it. Here are a few ideas I have used to help giving more thought to the spend:

- When entering a shop ask yourself if you needed the specific item before entering the shop.

- Am I making an impulse decision that I might regret.

- Was the item on your shopping list.

- How often will you use this item.

- Is there something else at home that would suffice, or have a dual purpose.

- If you are unsure about the spend leave the decision to purchase for a few weeks.

- Ask yourself if there is a second hand item available at a considerably reduced price.

Chapter 5 is worth a read, and a good reminder to value your hard work.

Decision - to sell or renovate

Walking in the afternoon is good for my health, though walking and gazing at the houses being demolished, renovated, upgraded sure makes the time go quickly when there can be so much to observe. What?

- Machines get stuck in the mud during excavation

- Piles of stuff are sitting ready for construction to happen

- Side fences are being pulled down and retaining walls erected

- Houses are being lifted to make use of the available space for the growing family

- Windows and doors are being upgraded

- Decks are being added to increase the living space

- Even just adding a "loo" or shower is a worthwhile thing to do

Nothing wrong with doing improvements in small junks. Investing in your home, especially when/if the mortgage has been reduced by 15 years, and you have decided this is a pretty good area to live, which often means you are not "going for broke" by doing some building improvements.

Reengineer

Reengineer

Renovate

Renovate

Refurbish

Refurbish

The conclusion is whatever extra money that is committed, and without breaking the bank, it is a fact that the spend will surely give a "bumper return" in the future.Chapter 6 refers.

Snooping in the rain

We have had so much rain for the last week it would be beneficial to go driving around to find where to/where not to buy land or houses.

Don't be scared about News items

Don't be scared about a News item "migration at a 20 year high" affecting your home ownership/investment. This idea could benefit you The newbie buyer must look beyond "the now". What?

When you think about my points a newbie can be in their 20's or their 50's or 60's. An investment is cheapest when realising when its potential will come about, and that is not necessarily now because it would have already realised heaps of its potential. Young people should not be expected to grab real estate in developed areas by the "throat". Why not? Because another person/owner/seller has already made their "killing". Yes the surge will assist change the market, but not necessarily for the newbie buyer's benefit. The decision now lies in the decision to buy having a mortgage or for cash depending which suits your situation.

Underneath there are two pictures, ie one for the patient and one for the not so patient. Chapters 6 & 7 give helpful information when choosing.

Ways of entering the market

This is just one example of how to enter a market that is changing quicker than you can save for what you would like to purchase outright.

The photos below show a home that was purchased about 15 years ago by a young couple, and a small renovation took place to jazz up the kitchen and lounge/deck to make day to day living more comfortable. This part of the new renovation will remain in place and heaps of lifting, nailing, banging will take place to the older part of the house to bring it up to the latest standards plus make room for the three additions to the brood. So this family bought something that would suffice for the time being and enable them to get into the market. Why?

- They got into the market 15 years earlier when prices were more affordable.